Land registration and ownership in Israel—Although there are numerous issues that arise when purchasing real estate in Israel, the primary questions that should come to mind for any potential purchaser is: “What am I purchasing and where is my property registered?”

In Israel, there are various types of registration of land and many forms of ownership which could be the subject of a long academic thesis. For purposes of simplification, the two main forms of ownership are “בעלות” which is private ownership (or free-hold), and “חכירה” which is known as leasehold. Privately owned land can be freely transferred subject to certain technical requirements. Leasehold property on the other hand can, under certain circumstances, be much more limiting. The main leasehold property in Israel is property on which the title of the land is held by the State and the individual apartment “owner” receives a long-term lease of typically 49 years with a right of renewal for an additional 49 years. There is also Church land property in which the land is owned by a third-party i.e. the Church, leased from the Church by the State, and then sub-let to individual apartment owners under the terms of a long-term sublease.

When selling leasehold property there can be two potentially limiting factors at sale (1) under certain circumstances, the State requires the payment of a lease transfer tax and (2) for non-citizens, the State requires, as a pre-requisite for land transfer, that the purchaser be entitled to become a citizen by virtue of the Law of Return. In addition, other questions that arise regarding lease property are what happens at the expiration of the lease? Is the lease renewable? If, not must I surrender my property to its owner at the end of the lease period? These are questions that must be answered prior to purchase, questions which can be answered by expert, legal professionals.

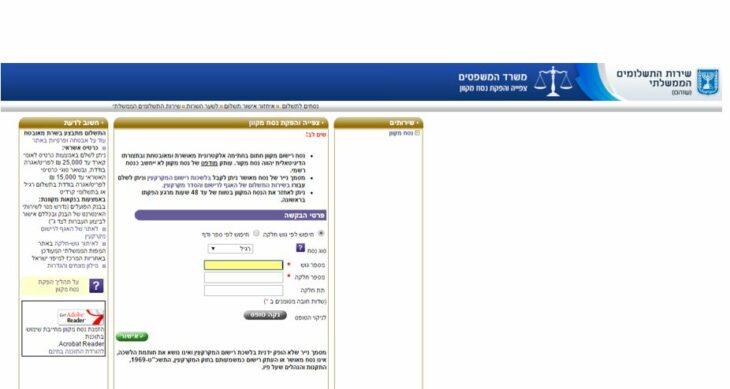

As far as registration is concerned, while nearly all land has a designation and is recorded in the land registry (“Tabu”), the actual rights in an apartment are not always to be found in the land registry. Further, even if the property is registered in the Land Registry, there are two different forms of land on which properties are built (in addition to the question of leasehold and free-hold as discussed above), “organized” and “non-organized” land. For purposes of properties that are organized, a title check at the Land Registry is deemed to be an irrebuttable presumption of ownership, while for non-organized property, it is a rebuttable presumption of ownership. What this means, in laypersons terms, is that when purchasing property built on non-organized property, further title searches are required.

In most cases, older properties, i.e. 10 years or more (there are many exceptions to this rule) are typically recorded at the Land Registry. More specifically, in the case of an apartment located in a building, the building is typically registered as a condominium with each individual apartment being defined as a sub-parcel in that same condominium. In newer construction, however, although the rights in the land on which the property is built are typically recorded in the Land Registry, the individual apartment owners’ rights will usually be recorded in the books of the company that built the property. While the Land Registry record is an open record, and with a little knowledge one can typically locate the registration of almost any property in the Land Registry, the private registry of the company is a closed record which only the company and the individual apartment owner can access. Therefore, when purchasing in newer construction, one must carry out more thorough checks in places other than the Land Registry.

This article in no way does justice to the deep and more complex aspects of ownership and registration of land in Israel and is merely an attempt to give the reader a cursory glance of issues that need to be considered prior to purchasing property in Israel. In most cases, after receiving guidance from competent professionals, many of these complexities can be overcome.

Josh Portman, is the owner and managing partner of Portman Law Offices. With nearly 25 years of experience in representing foreign residents, primarily from English-speaking countries, in purchasing real estate in Israel, he has particular expertise in representing clients purchasing apartments off-plan. Adv. Portman can be reached by email at [email protected].